The EU Digital Identity will be available to EU citizens, residents, and businesses who want to identify themselves or provide confirmation of certain personal information. It can be used for both online and offline public and private services across the EU.

Every EU citizen and resident in the Union will be able to use a personal digital wallet.

The right of every person eligible for a national ID card to have a digital identity that is recognised anywhere in the EU

![]()

A simple and safe way to control how much information you want to share with services that require sharing of information

![]()

Following a Commission Recommendation from 3 June 2021, a Member States Expert Groups is developing a Toolbox including a technical Architecture and Reference Framework (ARF), a set of common standards and technical specifications and a set of common guidelines and best practice, to make European Digital Identity Wallets truly a practical tool for all. The Commission regularly publishes the results of the work of the expert group .

Prior to its roll-out in Member States, the EU Digital Identity Wallet is piloted in four large scale projects, that launched on 1 April 2023. The objective of these projects is to test digital identity wallets in real-life scenarios spanning different sectors. Over 250 private companies and public authorities across 25 Member States and Norway, Iceland, and Ukraine will participate.

The European Commission will also provide a prototype of a EU Digital Identity Wallet (EUDI) as set out in the proposed European Digital Identity Regulation.

Digital identification systems offered by governments in the EU today have several important shortcomings: they are not available to the whole population, they are often limited to online public services and not allow for seamless access cross-border.

Only 14% of key public service providers across all Member States allow cross-border authentication with an e-Identity system, for example to prove a person’s identity on the internet without the need for a password. The number of successful cross-border authentications per year is very small, though on the increase.

72% of users want to know how their data is processed when they use social media accounts. 63% of EU citizens want a secure single digital ID for all online services (Eurobarometer survey)

![]()

Widely useable as a way of identification or to confirm certain personal attributes for the purpose of access to public and private digital services across the EU

![]()

Giving full control to users to choose which aspects of their identity, data and certificates they share with third parties, and keep track of such sharing

With the EU Digital Identity Wallets, citizens will be able to prove, across the EU, their identity where necessary to access services online, to share digital documents, or simply to prove a specific personal attribute, such as age, without revealing their full identity or other personal details. Citizens will at all times have full control of the data they share and by whom.

The EU Digital Identity can be used for any number of cases, for example:

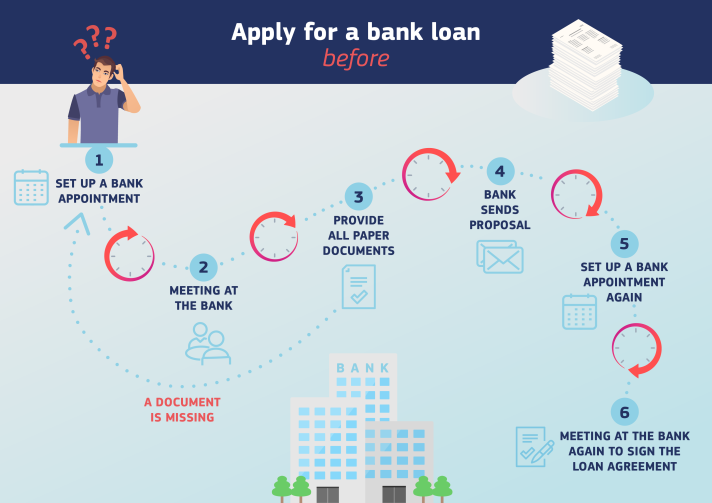

Applying for a bank loan is a process that typically includes numerous steps, from setting up appointments and having physical meetings, to collecting and signing all the paper documents - and repeating the operation if documents are missing.

By using the EU Digital Identity, the user only has to select the necessary documents that are stored locally on his digital wallet to reply to the bank’s request. Then, verifiable digital documents are created and sent securely for verification to the bank, who can then continue with the application process.

The following identification and trust services can already be used with legal effect across the EU thanks to the trust framework created by the eIDAS Regulation. They are key tools to enable trust and security in the Digital Single Market. Some services, like eSignatures, will be integrated into the wallet to facilitate their use.

![]()

eSignature

Expression in an electronic format of a person’s agreement to the content of a document. The function will be integrated into the wallet.

Will help me to sign legal documents and email without printing any paper

Will reduce costs and time through streamlined processes and help innovate business procedures

![]()

eTimestamp

Electronic proof that a set of data existed at a specific time

Will give me proof that I have bought my concert tickets

Will enhance document tracking and achieve greater accountability

![]()

eID

A way for businesses and consumers to prove their identity electronically

Will allow me to open a bank account in another country with my national ID

Will expand my customer base, save costs and time, and build trust in cross-border transactions

![]()

Qualified Web Authentication Certificate

Ensure websites are trustworthy and reliable

Will let me know that the websites and apps I like using are trusted and safe

Will increase consumer trust and help avoid phishing, protecting the reputation of my business

![]()

eSeal

Guarantee both the origin and the integrity of a document

Will guarantee that the football tickets are real and are not counterfeit

Will reduce costs and time through streamlined processes and promote trust in the origin of the document

![]()

Electronic Registered Delivery Service

Protects against the risk of loss, theft, damage or alterations when sending documentation

Will guarantee that my son’s birthday present arrives safely

Will reduce time and cost in document exchange, increase efficiency and trust and improve document tracking